It’s not just a tech stack, but a new methodology for restructuring financial order.

1.1 Macro Backdrop: Era of Asset Misallocation

1.2 Founders’ Journey: Engineers from the Storm

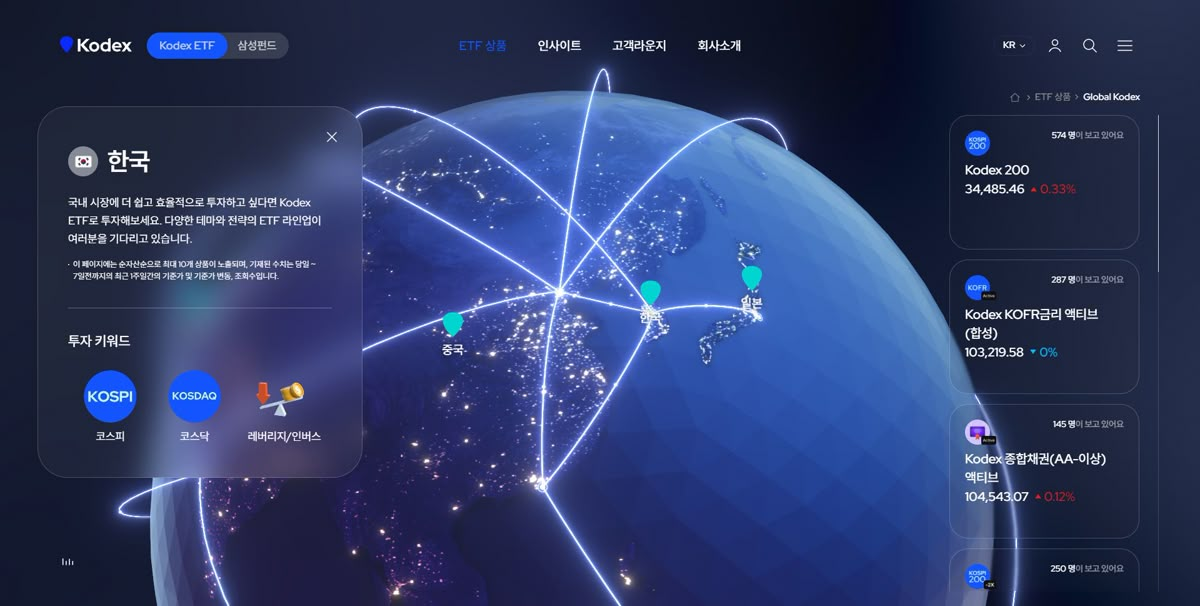

1.3 The Strategic Role of RWA: Awakening Assets On-chain

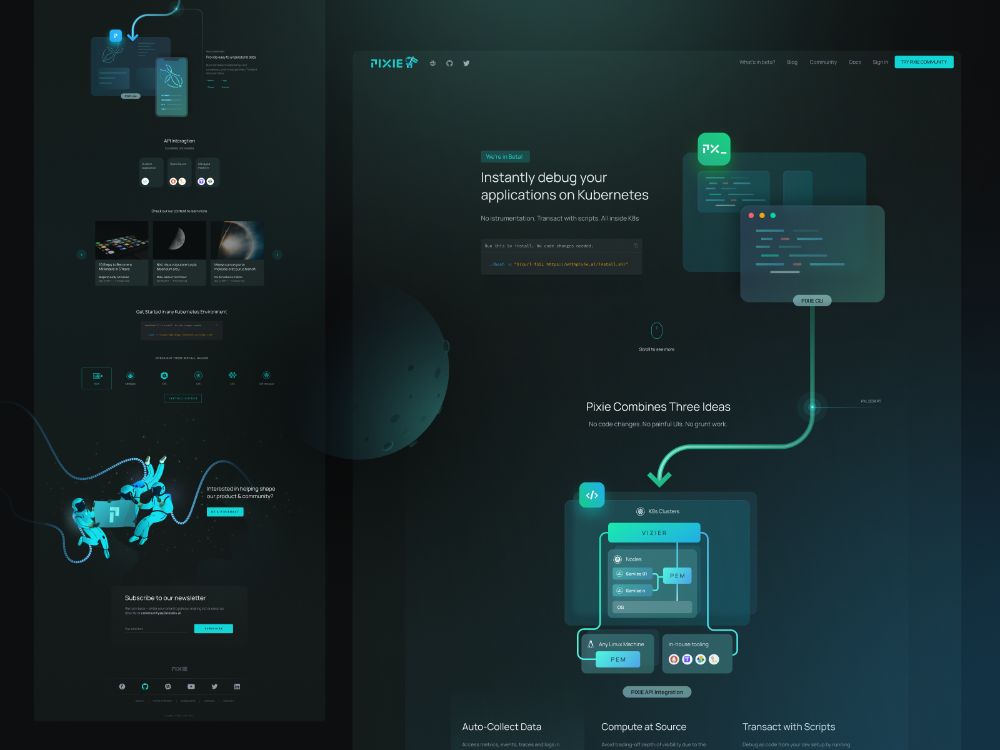

2.1 What is Nexus?

2.2 Project Goals & Vision

2.3 Four Industry Penetration Logics

2.4 Platform Differentiation

2.5 Why Nexus?

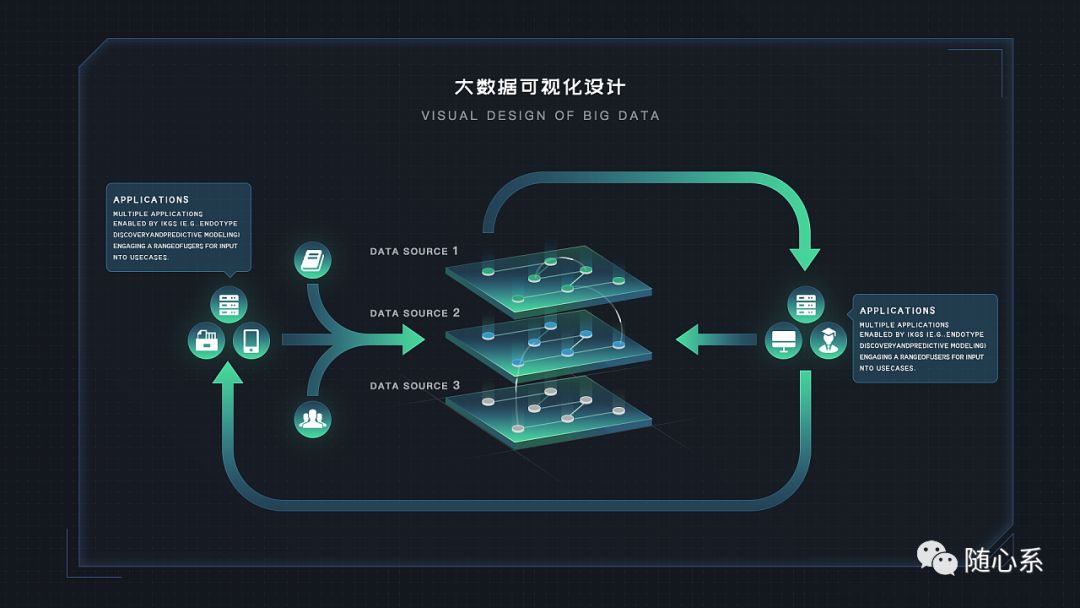

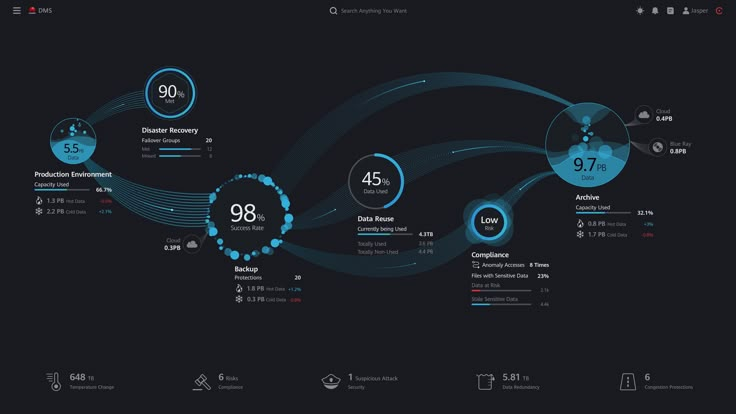

3.1 Dynamic Asset Passport: Digital Twin of Every Asset

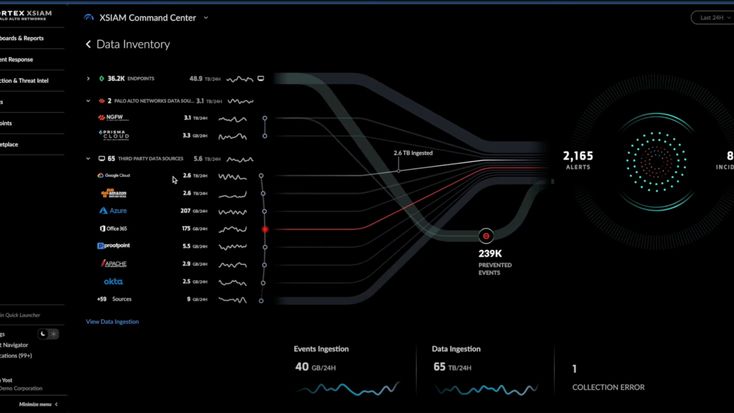

3.2 Compliance Oracle System: Multi-jurisdiction Compliance

3.3 Modular Asset Protocol & Data Structure

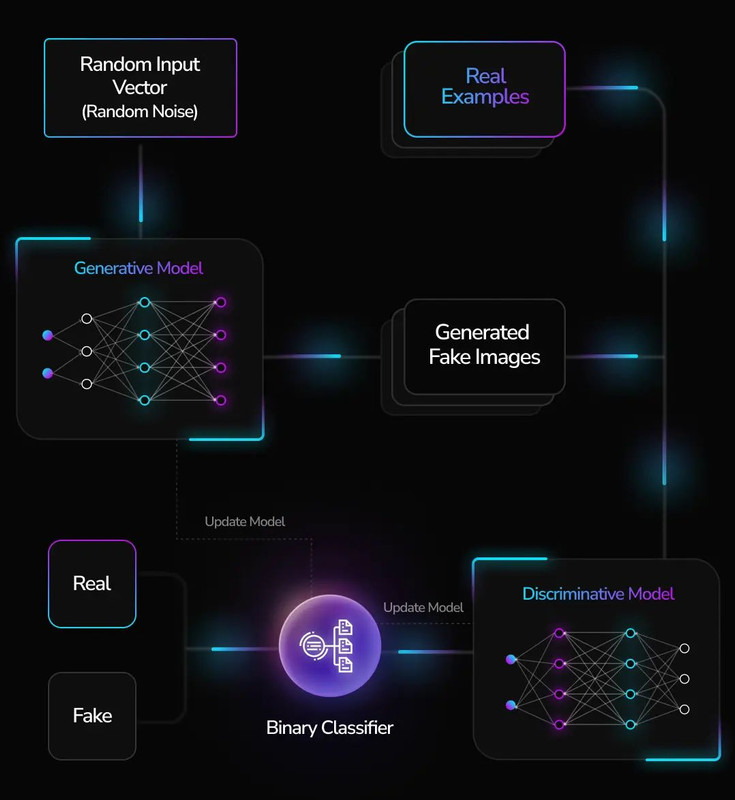

3.4 Fusion of Oracle, IoT, and AI

4.1 New Energy: Tokenization of EV Charging Revenue

4.2 Hospitality: NFT Hotel Entry & Triple Rights Structure

4.3 Healthcare: NFT Hospital Beds & Liquidity Restructuring

4.4 Art: Fractional Investment & On-chain Provenance

4.5 Summary: Nexus Model Advantages in Industry Liquidity

5.1 NEX Main Token: Function & Governance

5.2 NEXW Ecosystem Token Model

5.3 Revenue Closed-Loop Pathway (Visual Diagram)

5.4 Dual-Token Complementarity & Deflationary Logic

5.5 Value Advantage Compared with Other Public Chains

6.1 Compliance Structure: SPV + VASP Model

6.2 Multi-jurisdiction Strategies

6.3 Compliance Oracle & Audit System

6.4 DAO Governance & Regulatory Integration Outlook

7.1 Nexus Commercialization Loop

7.2 Revenue Model & Structured Financial Products

7.3 Five-year Roadmap: From Platform to OS

7.4 Conclusion: The Structural Revolution of RWA Internet

I. Era Background: Structural Fracture and Asset Silence

Since 2023, Asian capital markets have entered a stage of high interest rates, low leverage, and heightened compliance. While the real economy appears prosperous, there is an underlying systemic fracture: countless real-world assets with stable cash flow are regarded as "illiquid black boxes" by capital markets due to the lack of standardized structural expression.

- A hotel chain in Chiang Mai with 85% average occupancy cannot complete financing in Singapore because of ambiguous valuation and indivisible assets.

- An Indonesian EV charging operator has stable revenue and cash flow, but cannot participate in DeFi markets due to the lack of on-chain asset credentials.

- Private hospitals in the Philippines operate at full capacity, yet cannot secure financing for basic expansion, as their assets lack tokenized representation.

The issue lies not with the assets themselves, but in their lack of structural expression.

II. Founding Motivation: Structure, Not Just Narrative

In the face of these "expression fractures" across Southeast Asia and HK/SG economies, three founders from traditional finance, cross-border clearing, and blockchain compliance backgrounds decided to act:

They share the belief:

"Valuable real-world assets lose their voice not due to lack of returns, but lack of structure."

III. Launch of the Nexus Structuring System

Nexus was not launched as a simple asset issuance platform, but as a comprehensive RWA Structuring System, built on four core capabilities:

- Asset identification & standard mapping: Real-time validation and digital twinning of asset data using IoT, oracles, and dynamic passports.

- Legal structure generation & compliance matching: Automatic fit to financing markets via SPV (Hong Kong) and VASP (Singapore) mechanisms.

- Financial instrument modularization: Modularizing yield rights, usage rights, and ownership into NFTs, tokens, and smart contract certificates.

- Real-world consumption loop: On-chain tokens are not only for financing, but also usable for hotel stays, bed redemption, art exhibitions, and more.

IV. Comparative Analysis: Nexus vs. Mainstream RWA Projects

| Project | Positioning | Tech Structure | Compliance | Consumption/Utility | Key Difference |

|---|---|---|---|---|---|

| Centrifuge | Asset Lending Platform | On-chain asset pool + NFT certificates | US foundation compliance | None | Institutional credit only; asset scope narrow |

| Maple | Crypto Credit Market | Institutional credit scoring | Compliance unclear (DeFi credit) | None | No real-world asset processing |

| Ondo | Asset Tranching | T-Bill/US Bond Mapping | Strict (US only) | US investors only | No multi-scenario utility |

| Nexus | RWA Structural System | IoT + Passport + Compliance Engine | HK/SG dual license, Asia fit | Hotels, healthcare, art, multi-scenario | Physical focus, end-consumer orientation |

V. Project Milestones & Implementation Roadmap

- 2024 Q1-Q2: Complete asset passport protocol testing; high-end hotel SPV whitelist pilot (Chiang Mai)

- 2024 Q3-Q4: Integrate EV charging operators; officially launch NFT bed model

- 2025 Q1: Launch NEX/NEXW dual-token system; start consumer token circulation pilot

- 2025 Q2-Q4: Launch Pendle-based yield packaging derivatives, enable secondary RWA liquidity products

- 2026+: Establish global cross-border compliance alliance (EuroRWA / AsiaRWA / LatAmRWA)

VI. Conclusion: From Silent Assets to Structural Expression

- Physical foundation (electricity/occupancy/usage)

- Legal structure (SPV / NFT)

- Financial logic (yield distribution / discounting)

- Consumption scenarios (hotel / art / healthcare)

The future asset market will no longer rely solely on narrative and consensus, but on structure, data, and real-world liquidity.

Nexus is the first “on-chain neural hub” in this structural revolution.

I. RWA's Essence: Not Assets, But Structure

In the past five years, RWA (Real World Asset tokenization) has followed two distinct evolutionary paths:

- Tokenization-as-a-Service: Projects like RealT, Ondo, and Maple focus on asset issuance, but lack deeper structural logic.

- Structure Standardization Model: Projects like Nexus and Centrifuge seek to rebuild asset financial readability at the protocol level.

Most projects treat RWA as "minting an NFT on-chain," but ignore three core off-chain challenges:

- Data unverifiable → cannot be priced → cannot be financed

- Legal structure fragmented → cannot be cleared → cannot exit

- Lack of scenario binding → cannot be consumed → no liquidity

Nexus's core claim: "Assets do not lack value—they lack structured paths of expression."

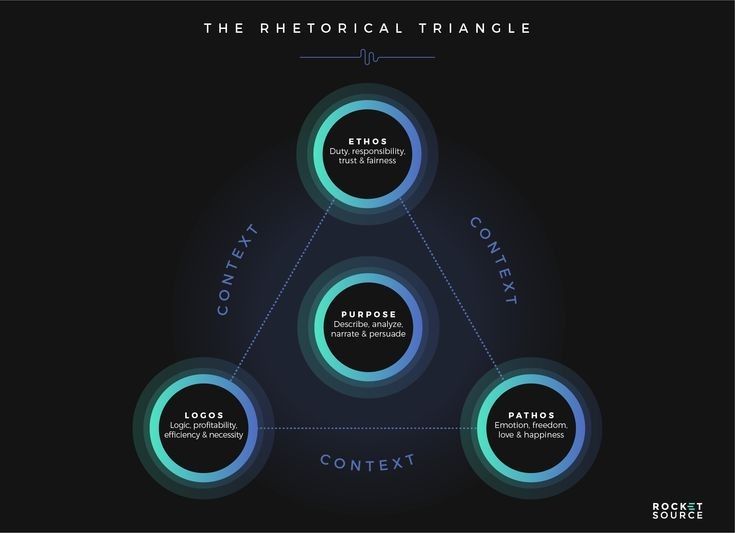

II. Nexus's Core Value Proposition — Three Pillars

1. Asset Structure Reassembly

- Via Dynamic Asset Passport, every asset's off-chain data (IoT, electricity, environment, contract ID) is packaged as an on-chain identity credential.

- Each asset's revenue flow, physical status, and valuation forecast can be machine-expressed.

- Achieve digital twinning of off-chain assets.

2. Compliance Structure Adaptation

- Powered by HK SPV and SG VASP architectures, auto-generate issuance routes matching target market compliance.

- Scalable oracle verification, real-time monitoring of regulatory status and compliance changes.

- Templates for multi-country compliant asset issuance.

3. Consumption Value Conversion

- Integrate NEXW tokens into real-world usage scenarios (hotels, healthcare, EV charging, art).

- Form an on-chain "investment–usage–consumption" closed loop.

- Reduce speculation; strengthen long-term token value anchoring.

III. Comparative Analysis: Nexus vs. Industry Peers

| Project | Core Positioning | Tech Structure | Compliance Path | Scenario Application | Key Difference |

|---|---|---|---|---|---|

| RealT | Real Estate NFT Platform | Asset fractionalization + on-chain registry | US private placement exemption | None | Single scenario, no secondary liquidity |

| Ondo | US Treasury Mapping | Tranching bond structure | Strict compliance, US institutional | None | Financial focus, single asset type |

| Maple | Credit Pool/Scoring | Credit lending contracts | No clear regulatory gateway | None | Pure financial credit, no real asset |

| Centrifuge | On-chain Asset Lending | NFT collateral + credit pools | Limited compliance fit | None | Institutional, weak asset scenarios |

| Nexus | On-chain Asset Structuring System | IoT + Passport + SPV + NFT + Consumer Token | HK/SG dual engine, multi-jurisdictional | Hotels / EV / Art / Healthcare | Cross-industry, on-chain consumer closed loop |

IV. Key User Value Breakdown

| User Type | Value Realization |

|---|---|

| Asset Owners | Access to financing + on-chain expression + scenario-based monetization |

| Institutional Investors | Low-volatility, high-return asset allocation + DeFi arbitrage via tokens |

| Retail Users | Participate from as low as $10 in art, medical, hotel asset dividends + consumer tokens |

| Legal & Regulatory | On-chain auditability + AML structural tracking |

V. Industry Collaboration & Structural Moat

- Universal asset protocol (passport + unified oracle structure)

- Compliance layer modularity (SPV, VASP, deployable modules)

- Consumer end driven by the NEXW usage ecosystem, promoting token utility

This means: every new industry integration is not a system rebuild, but "shell and connect" structural duplication.

VI. Conclusion: Structure is Consensus, Structure is Credit

Nexus aims not to build a platform, but to create a new language of asset expression. It enables asset data to be read, legal structures to be standardized, and consumption scenarios to be executed, ultimately achieving:

- Credit = Structure + Data + Settlement

- Token = Equity + Discounting + Usage Rights

The future asset market will revolve not around centralized finance, but around structural standards and circulation.

Nexus is not just financial innovation—it's the constructor of digital grammar for real assets.

I. Why Can't Assets Truly Go On-chain?

In traditional finance and early Web3 RWA implementations, a common misconception is that "on-chain assetization" equals "tokenization". Many platforms issue NFTs, ERC-20 tokens, or structured certificates claiming asset digitalization, but three core problems remain:

- Asset data source is unclear, off-chain behaviors are unverifiable, and there is no credible scoring logic.

- Data and legal structures are decoupled, with no audit or traceability path.

- No regulatory integration—assets become digital islands.

In other words: the on-chain world lacks a syntax that "understands real-world language". This is why Nexus introduces the Asset Passport Protocol.

II. What is Dynamic Asset Passport (DAP)?

DAP is Nexus's semantic protocol layer for assets, generating a "digital identity" and "structural description" for each real-world asset, with five core capabilities:

| Module | Description |

|---|---|

| 1. Physical State Mapping | Real-time asset data upload using IoT chips and sensors (e.g., charging station, energy meter, artwork humidity) |

| 2. Ownership Structure Calibration | Bind asset's ownership/yield/use-rights, map via NFT/SPV to generate on-chain certificate |

| 3. Financial Behavior Tracking | Automatically record actions like yield, leasing, depreciation, insurance—build full asset history |

| 4. Oracle Verification | Multi-source validation (IoT, accounting, regulatory APIs) for consistent, trustworthy data |

| 5. Compliance Data Output | DAP auto-generates regulatory-compliant reports for different legal jurisdictions |

Nexus is not building just a platform, but a universal language protocol layer for real assets.

III. DAP vs. Traditional On-chain Asset Models

| Dimension | ERC-721/NFT | Financial Contract Certificate | DAP (Nexus) |

|---|---|---|---|

| Asset Expressiveness | Represents "ownership" only | Represents static rights/rates | Describes full lifecycle and dynamic asset behaviors |

| Data Trustworthiness | No off-chain verification; only issuer credibility | One-time write or hardcoded | Real-time IoT + multi-oracle validation |

| Compliance Adaptability | Cannot link to legal structures | Limited SPV integration | Embeds in SPV/VASP/AML for auditability |

| Consumability | Rarely scenario-based | Mainly for OTC trading | Enables true on-chain consumption (hotels, EVs, exhibitions) |

IV. DAP Technical Workflow (Text Version)

- Off-chain asset registration: Register asset ID via API/manual (e.g., bed #, charger serial #, hotel room #)

- IoT data integration: Connect sensors to capture live status (current, voltage, humidity, occupancy)

- Ownership structure input: Upload legal docs; smart contract records rights structure

- DAP encoding: System generates standard passport doc (JSON + signature + CID + timestamp)

- On-chain passport registration: DAP uploaded to IPFS/Arweave + oracle validation, creating unique asset passport address

- Investment certificate generation: Split rights (yield/use/governance) into NEX/NEXW tokens

- Compliance output: DAP report delivered to regulatory bridge (e.g., MAS, BSP, HK-FSTB) or audit tools (e.g., Chainalysis)

V. DAP Integration: Bridging On-chain & Off-chain Structures

- SPV Integration: Each asset maps to an SPV; DAP acts as data bridge, ensuring asset-token consistency.

- NFT Compatibility: DAP structure binds to ERC-721/1155, allowing cross-platform transfer and display.

- DeFi Integration: DAP-certified assets can split into yield certificates (e.g., Pendle), joining liquidity markets.

VI. Case Study: DAP in Four Industries

| Scenario | Off-chain Asset Structure | DAP Mapping | On-chain Result |

|---|---|---|---|

| Hotel Room | Room # + property certificate + business license | Ownership info + stay history + future bookings | NFT room certificate + yield payout model |

| Hospital Bed | Medical license + department usage + device config | Bed ID + doctor schedule + current occupancy | Pledge for financing / clinical right NFT |

| EV Charging Network | Current sensors + grid contract | kWh data + operation time logs | kWh yield certificates, payment module |

| Artwork | NFC + provenance info + exhibition history | Provenance chain + physical state + ownership | Fractional NFT sale + exhibition yield token |

VII. Future: Expanding DAP Interoperability

- Multi-chain deployment: DAP runs on Ethereum, Polygon, Arbitrum, BNB Chain for cross-chain asset sharing.

- AI verification: Use AI for authenticity (e.g., artwork image analysis, automated compliance scoring).

- CBDC/stablecoin integration: DAP assets and NEXW tokens interoperate with eHKD, USDC for payment-validation linkage.

VIII. Conclusion: Building an Asset "Grammar System"

If NFTs are words, SPVs are sentences, and smart contracts are paragraphs, DAP is the grammar that lets assets "speak". It combines physical actions, ownership structure, and compliance rules into a machine-readable, regulator-auditable, and investor-verifiable asset format. In tomorrow's multi-chain, cross-domain, data-driven asset networks, Nexus DAP will be the semantic engine connecting the real world to the on-chain world.

I. Why is "Modularity" the Premise for On-chain Reality?

Traditional asset structures are complex, with lengthy transfer paths and ambiguous yield distribution. Tokenization cannot simply "copy existing structures"—it requires modular reconstruction.

Nexus proposes: On-chain Expression = Module + Permission + Standard.

- Split and reconstruct ownership, usage, and yield rights of real assets

- Combine, encapsulate, and circulate via smart contracts

- Achieve cross-industry and cross-scenario asset standards

II. Core Model: Trichotomy & Standard Composition

| Layer | Module | Description |

|---|---|---|

| Asset Layer | AssetHeader | On-chain asset registration (real address, valuation, partner orgs) |

| Rights Layer | RightSplitter | Split ownership, yield, and usage into tokenized structures |

| Scenario Layer | AccessNFT | Scenario-based NFT credentials (e.g., hotel stay, bed booking) |

- Example: A hotel room generates:

- Ownership Token (tradable by investors)

- Yield Token (quarterly dividends)

- Scenario NFT (for user booking/use)

- This structure enables fractionalization, composition, and scenario-based expression.

III. Module Universality & Cross-industry Assembly

- Protocol model supports multi-industry "lego-like" assembly

- SPV integration auto-generates compliant modules

- All modules follow unified interfaces, enabling secondary structured trading

This enhances asset standardization for issuers, combinatorial power for investors, and transparency for regulators.

IV. Contract Structure: Generation to Verification

- SPV/asset party uploads off-chain proof docs

- Nexus node triggers Factory contract to generate modules

- Asset passport created, rights split written on-chain

- Compliance modules (KYC/AML/tax) auto-attached

contract AssetFactory {

function createAsset(address owner, string memory assetType,

string memory location, uint256 value) public returns (address);

}

V. Comparison with Other Industry Protocols

| Model | Modularity | Cross-industry | Compliance Fit | Scenario Fusion |

|---|---|---|---|---|

| Nexus | High (3-way split + NFT) | Yes | Multi-jurisdictional standard modules | Multi-scenario NFT + consumer token |

| RealT | Medium (real estate only) | No | US single market | None |

| Centrifuge | Medium (AR structure) | No (finance only) | EU focused | None |

| Maple | Low (contract-only) | No (lending only) | None | None |

VI. Conclusion: Modules as the Language of On-chain Reality

- High universality: composable across industries

- Regulator-friendly: verifiable data structures

- User clarity: scenario mapping via AccessNFT

- Investor flexibility: structured trading & yield packaging

Every real asset is no longer a "point", but a "structure"—decomposable, composable, verifiable, and empowered on-chain.

I. The Historic Misconception of Tokenomics

In early crypto, tokens were designed to drive hype and incentivize holding. In RWA, tokens must serve as structural connectors, value recorders, and yield distributors.

Nexus builds not a single-token loop, but a dual-token structural system:

- NEX: Sovereign asset token for governance, dividends, and system rights

- NEXW: Utility token for RWA yield & on-chain consumption

- The two form a full loop of Investment → Yield → Consumption

II. NEX: Sovereign Asset Token (Governance & Value Capture)

- Staking/locking for basic platform yield (20% profit + 5% fee buyback pool)

- Eligible for partner airdrops & ecosystem rewards

- Governance: vote on listings, yield rates, etc.

- Deflation: 20% platform income used for buyback & burn; 5% of transaction fees to burn pool; more locked supply

Model: If annual revenue is $20M, trading volume $100M:

Buyback = $4M/year; Burn ≈ 39% of total supply in 3 years, increasing scarcity.

III. NEXW: Ecosystem Token Anchored to RWA Yield

- Anchored by:

• 50% cash reserves (multi-asset stable pool)

• 50% RWA yield rights (hotel, charging, medical, art) - Clearing pool supported by partner banks (T+0)

- Use cases:

Scenario Description Required NEXW Hotel stay Book designated hotels in ecosystem 100~500/night EV charging Pay for power at partner stations ~0.3/unit Art NFT purchase Bid in NFT mall with NEXW $10~$1000 NEXW Medical bed pledge Deposit for clinical bed NFT 3,000+

NEXW acts as a "consumption voucher"—the fiat function for on-chain RWA.

IV. Value Capture: How Tokens Map Real-world Yield

- RWA pools: Asset data & yield (e.g., charging) → NEXW reserves

- Circulation: All NEXW spent goes to buyback pool, recirculated for stable reserves

- User repurchase: Users buy/redeem NEXW for repeated access

- Investor: NEXW as yield certificate, integrating floating yield model (e.g., Pendle)

V. Comparison of Tokenomics with Other Protocols

| Project | Main Token | Utility Token | Real-world Anchoring | Scenario Support |

|---|---|---|---|---|

| Ondo | Single-token (governance + yield) | None | US Treasury | None |

| RealT | Single-token + NFT | None | Property income | None |

| Centrifuge | NFT as certificate, CFG as main token | None | AR receivables | None |

| Nexus | NEX (governance/dividend/burn) | NEXW (consumption, RWA yield) | Multi-industry cash flow | Multi-scenario |

VI. Conclusion: Restoring Economic Meaning to Tokens

The design of NEX and NEXW abandons pure hype and algorithmic peg bubbles:

NEX = structural value rights; NEXW = usage and circulation unit.

Together, they form a closed loop: "real asset cash flow → token expression layer → financial derivatives".

NEX will evolve to play the roles of "platform governance + cross-chain clearing node"; NEXW becomes the universal value language of real-world assets.

This is the Nexus token philosophy: not coin minting, but structural economics.

I. RWA: Not Just Asset, But Legal Structure

In Nexus's vision, "structural credibility" for RWA is not just a technical issue but a legal one. Every asset in the real world carries ownership, yield, usage, tax, and compliance labels—all needing legal backing. Compliance design is not just a barrier; it is the channel itself.

II. Dual-jurisdiction Compliance: HK SPV + SG VASP

| Module | Description | Advantage |

|---|---|---|

| HK SPV | Entity holding asset ownership, registers hotel, charging, medical, etc. | Dual China-HK recognition, financing & legal protection |

| SG VASP | Licensed virtual asset service provider for token issuance, custody, flow | Global financial hub, cross-border legal compliance |

- All asset issuances start with SPV registry

- Tokens released by VASP with AML/tax modules

- All investors must pass KYC under Singapore law

- Annual Big4 audit with on-chain Proof of Reserve

III. Compliance Engine Module: Embedded Governance

- Dynamic AML/KYC with Chainalysis blacklist API

- FATF rule adaptation (EU, HK suspicious transaction flags)

- Compliance oracle: developed with NUS, auto-checks regulatory APIs and asset legal status

IV. Multi-jurisdictional Regulatory Adaptation Table

| Region | Regulation Support | Strategy | Feasibility |

|---|---|---|---|

| China Mainland | No retail RWA allowed | B2B + offshore structuring | ★★★☆☆ |

| Hong Kong | SPV + clear compliance path | RWA registry + DAO investment | ★★★★★ |

| Singapore | VASP/PSA dual licensing | All RWA on-chain operations supported | ★★★★★ |

| EU | MiCA supports specific tokens | Oracle-verified structural mapping | ★★★★☆ |

| US | Highly sensitive (securities law) | Qualified investor only | ★★☆☆☆ |

V. Trends & Governance Pathways

- Global regulation converging (MiCA, PSA, GDF, FATF, wallet KYC, CEX audits)

- CBDC integration (pilot with MAS for CBDC-token bridge)

- DAO-ization: asset structures governed by DAOs (e.g., "EV DAO", "Bed DAO")

VI. Conclusion: Law as Anchor, Not Chain

In Nexus, compliance is the foundation of a trusted ecosystem. It's not about government control, but about structural certainty—ensuring every token truly represents a bed, parking space, or yield. Nexus closes the loop from jurisdiction, technology, and data for legally trusted RWA.

I. RWA: A Global, Not Standardized, Market

Traditional assets are local, policy-based, and currency-fragmented. Nexus abstracts RWA from fragmented capital into cross-border financial products—a challenge of both technology and institutional culture.

II. Global Expansion Path: From Asset to Structure Output

| Stage | Goal | Sample Path | Requirements |

|---|---|---|---|

| 1 | Pilot single asset | SG hotel RWA / Thailand charging SPV+VASP | SPV, custody setup |

| 2 | Multi-asset + DAO pilots | Asia (VN, MY, JP, KR) | Modular legal integration |

| 3 | Governance + DeFi settlement export | EU, Middle East | Cross-chain, structural product |

- Goal: Nexus as the standard platform for global real-asset structure export

III. Nexus Business Model: Value Capture & Moat

| Revenue Source | % Est. | Description |

|---|---|---|

| Asset issuance fee | 25% | 1–3% fee for each asset onboarded |

| RWA custody fee | 15% | DAOized asset holders pay custody/settlement annual fee |

| NEX platform yield | 20% | Platform gains from RWA yield tokens |

| Structured finance tools | 30% | Bonding, yield certificates for institutions |

| NEXW secondary trading fee | 10% | Slippage fees from NEXW transactions |

- Moat: Modular asset protocol, compliance oracle, dynamic clearing

- Legal moat: dual-jurisdiction structure, auditable compliance, regular audits

- Community moat: DAO governance & distributed consensus

IV. Five-Year Roadmap: From Platform to RWA OS

- 2025 Q4: Launch EV/hotel/bed pools, close NEXW consumption loop

- 2026 Q2: First cross-chain financing DAO (HK+SG)

- 2027: EU sandbox + NFT security pilot

- 2028: "Asset bridge" to map any RWA from chain A to chain B

- 2029: Top-3 Asian RWA platform, >10 real asset types

- 2030: Nexus OS launch, SDK + clearing protocol for global RWA devs

V. Conclusion: The Structural Foundation of the Real Asset Internet

Nexus is not a speculative token narrative, but a foundational experiment in real-world asset restructuring. Its goal is to be the "TCP/IP" for real assets, giving every bed, parking space, EV station, and painting a verifiable, composable, tradable, and auditable digital structure.

Not just financial engineering, but an upgrade of real-world civilization itself.