NEXUS PROTOCOL

In a world where assets are misunderstood and data lacks trust, NEXUS reimagines how real-world assets are represented onchain. We don't just tokenize—we build the structural language of assets, enabling EV stations, hospitals, hotels, and artworks to gain identity, credibility, and liquidity on the blockchain.

Only when structure is clear, value becomes visible.

Asset Structuring

- Bind off-chain data (IoT, contract ID, sensors) to on-chain identities

- Express revenue, physical state, and valuation via data

- Create digital twins of physical assets

Compliance Adaptation

- Hong Kong SPV / Singapore VASP compliant issuance paths

- Oracle-driven monitoring of legal/regulatory status

- Templates for compliant multi-jurisdiction asset offerings

Value Conversion

- Use NEXW token in hotels, healthcare, charging stations, art markets

- Form a complete loop from investment to utility to consumption

- Reduce speculation and anchor long-term value

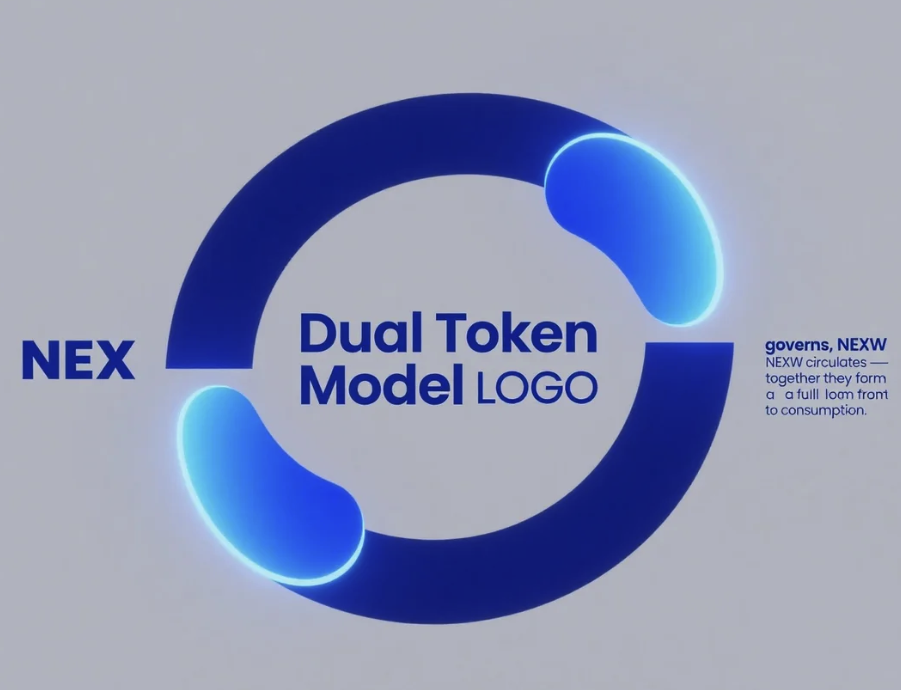

NEX governs, NEXW circulates. Together, they form a closed-loop cycle from capital to consumption, bridging real-world income and digital assets.

Through intuitive interfaces, NEX empowers users to convert real-world assets into NEXW, enabling decentralized interaction and programmable revenue flow.

The NEX ecosystem links governance, revenue, investment, and real-world applications through a unified token model—accelerating both value creation and trust.

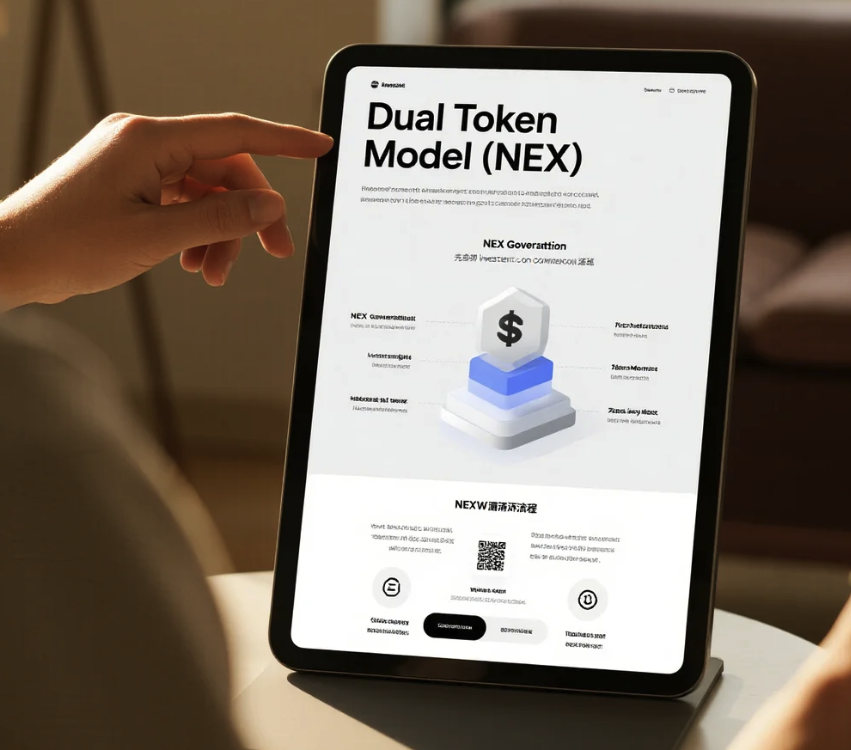

A structural design for Web3 RWA: NEX controls governance and decision-making. NEXW reflects usage and asset value. Enabling a true full-cycle asset framework.

NEX isn’t speculative — it anchors value in productivity. Every NEXW issued is backed by asset performance, demand, and user participation.

Asset tokenization transforms ownership. With NEXW, users directly access and trade yield-generating assets in a transparent and programmable way.

NEX holders shape the platform—Propose, vote, and influence every layer of the protocol’s real-world asset integrations.

NEXW can plug into DeFi, wallets, payment gateways, or smart contracts — enabling real-world usage beyond speculation.

NEX governs the orbital structure, while NEXW flows through it. This isn’t just tokenomics — it’s the architecture for structured, programmable asset capital.

1. The Fallacy of Single-Token Models

Early crypto economies used tokens for speculation. In RWA systems, tokens must become:

- ⚙ Structural connectors

- 💡 Value recorders

- 💰 Yield distributors

Nexus builds a dual-token structure:

NEX NEXWNEX: Governance + value capture

NEXW: Asset-backed consumption utility

2. NEX Token: Sovereign Asset Layer

Core Functions:

- Staking earns 20% platform profit + 5% fee buyback pool

- Airdrops from partners (e.g. Moolah)

- Voting power for asset onboarding, yield adjustments

Deflation Model:

- 20% of total revenue used to buy & burn NEX

- 5% of every fee enters burn pool

- Staking & lock-up reduce circulation

3. Burn Simulation

Annual Platform Revenue: $20M

Transaction Volume (EV + Art): $100M

Buyback Pool: $4M/year

Burn Ratio: ~39% of total supply in 3 years

This results in sharp token scarcity, aligning supply with real usage.